Component Lifespan Considerations for Industrial IoT OEMs

One of the major differences between consumer IoT – such as wearables and Nest® thermostats — and industrial IoT is the lifespan requirement for the components and modules used at the edge. Industrial IoT includes many different segments, ranging from medical to retail to transportation to building and factory equipment. While each of these segments has their own nuances and requirements, one key factor they share is that the modules and components that go into these connected devices, sensors and gateways must be able to endure a longer period of operation than consumer IoT devices.

One of the most stringent segments in Industrial IoT is manufacturing and process automation. In this segment, products are expected to last in the field 15, 20 years and sometimes even longer. For some of the other segments in Industrial IoT such as medical, banking, government, and gaming, product certifications take a long time, and sometimes, it takes years before a product hits the market, requiring the incorporated technology be available for an extended period of time.

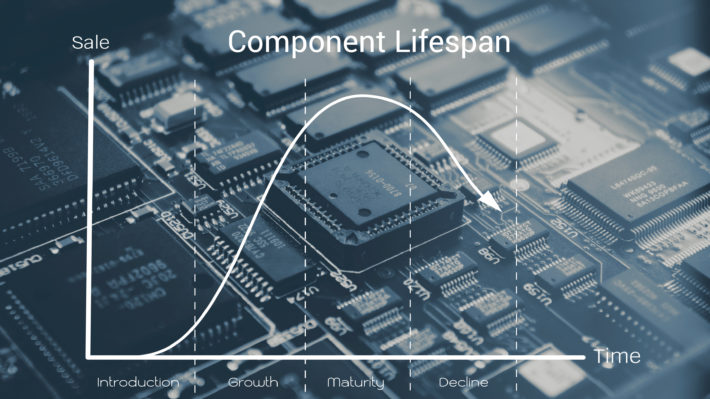

In contrast, the typical lifespan for most consumer components are 18-24 months and for most embedded components are 5-7 years long. These life spans are simply not sufficient for some of the most stringent Industrial Internet applications. Interesting enough, according to most analysts forecast, these segments (Industrial, Energy) are the biggest chunk of the IoT deployment opportunities in the next few years. With the forecasted size of this market, many OEMs in the PC industry, who have seen declines in their PC business, are entering the Industrial IoT market using the same consumer-grade component and module suppliers.

Despite ongoing technological advancements, most industrial OEMs cannot afford to continually upgrade their products. It’s simply too expensive and doesn’t make sense in the context of customer purchasing cycles. Think about it. How is life-cycle cost affected when a manufacturer must reconfigure the production of existing products every 18 months to two years using consumer-class components designed for PCs, smartphones, and other consumer appliances, or even 5-7 years for traditional embedded products when the product life span is 15 or 20 years? What are the additional validation cycles needed to ensure that upgrades don’t negatively impact currently installed hardware and software? In addition, what’s the cost in person-hours and time related to re-engineering, testing, and re-certification of the end product by the OEM?

For example, if a medical device OEM embarks on a new product design using a brand new component from a consumer-class component supplier who provides a 5-7 year long supply for a subset of the components that they classify as “embedded”, by the time the OEM’s product goes through development, validation, and certification by various regulatory bodies, and it hits the market, that component would already be more than halfway through its supplier lifespan!

Today, more and more industrial manufacturers have realized the true costs associated with using components and modules that typically have an embedded lifespan of 5-7 years. As a result, many industrial OEMs are requiring 10-15 year lifespan or roadmap as a “must have” in their RFPs. Components and modules that deliver long-term availability, such as Lantronix IoT building blocks and IoT gateways, reduce product lifecycle costs by providing OEMs with greater stability in the on-going production of an existing solution.

In a crowded marketplace with many options for IoT connectivity and enablement, how can industrial OEMs determine the best supplier for their product application? Here are a few questions to ponder:

- How long has the supplier been in business? This can be a key consideration when thinking about support for your product line throughout its lifecycle.

- Do they have referenceable long-time customers?

- Are they willing to share their product roadmap or do they have a product roadmap that communicates a commitment to long-term support for their solutions?

- How small or large are their form factors? Do they have multiple form factor options to support varying technologies? Size matters. With more and more OEMs seeking to pack more electronics and capabilities into their machines, the need for smaller and smaller components that accomplish more (and require fewer changes to machine size) is increasing. Also for industrial OEMs, finding an OEM that can provide long-time support for a specific form factor is important when considering not just your product’s lifespan but also its evolution and the costs associated with redesigning PCBs.

- What type of warranty do they provide? A one-year warranty – as is the case with many consumer class components — is not much value if your product development takes a few years.

- Is upgradeability built-into the solution design?

For Industrial OEMs, building a robust IoT solution requires important questions around the lifespan of your supplier’s components. It’s not just about how long your product will last – but choosing a partner and component whose longevity matches yours.

—Shahram Mehraban is the Lantronix VP of Marketing. Prior to joining Lantronix in February 2017, Shahram served as marketing director and chief of staff of the industrial and energy solutions division of Intel’s IoT Group. You can follow Shahram on Twitter @mr_iiot.